Under the ACA, insured and self-insured applicable large employers (ALEs), self-insured businesses of all sizes and health insurance providers must submit ACA information returns to the IRS, as well as provide recipient statements.

The two main types of ACA forms are “C” forms and “B” forms. In general, C forms pertain to employers, whereas B forms apply to providers (either insurance carriers or self-insured companies). All ALEs must complete C forms, regardless of whether health coverage was offered, or employees enrolled in the coverage. Insurance carriers and self-insured companies must complete B forms to show an individual had minimum essential coverage and isn’t liable for the Individual Shared Responsibility penalty.

For self-insured employers who are also ALEs, it’s acceptable to combine the information into a single 1095-C form, rather than filing for B and C forms.

Specifically, ACA information returns include:

Here’s additional guidance:

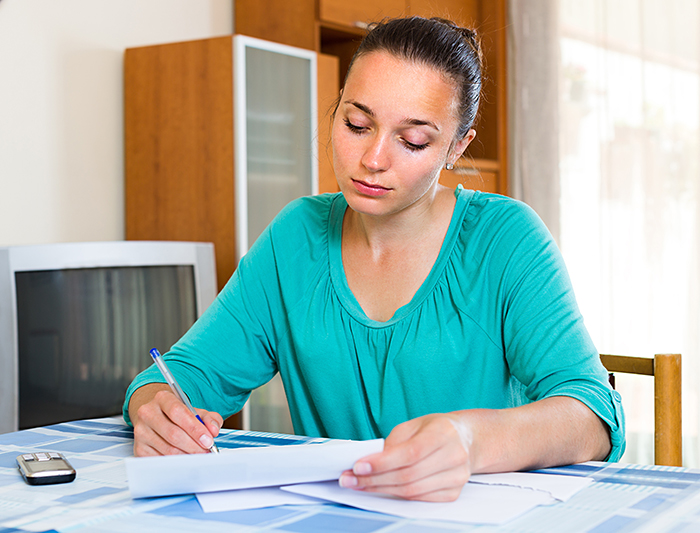

1095-B

Health Coverage

Self-insured employers who

have fewer than 50 FTEs and provide health plans

Insurance carrier issues for employers with employer-sponsored group health plans

Which months

the insured and his or her family were covered under the plan

Paper:

February 28*

Electronic:

March 31*

Insurance carrier submits for

employers with employer-sponsored group health plans

Yes, by

March 2

Insurance carrier submits for

employers with employer-sponsored group health plans

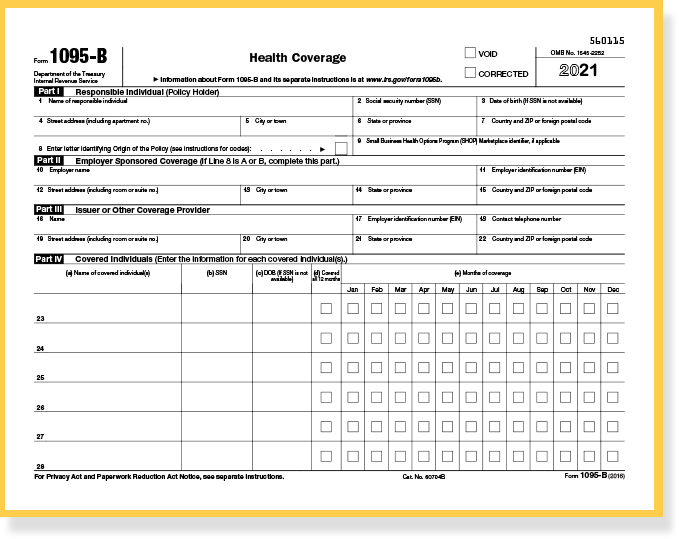

1094-B

Transmittal of

Health Coverage Information Returns

Summary transmittal

record of

1095-Bs

Paper:

February 28*

Electronic:

March 31*

N/A

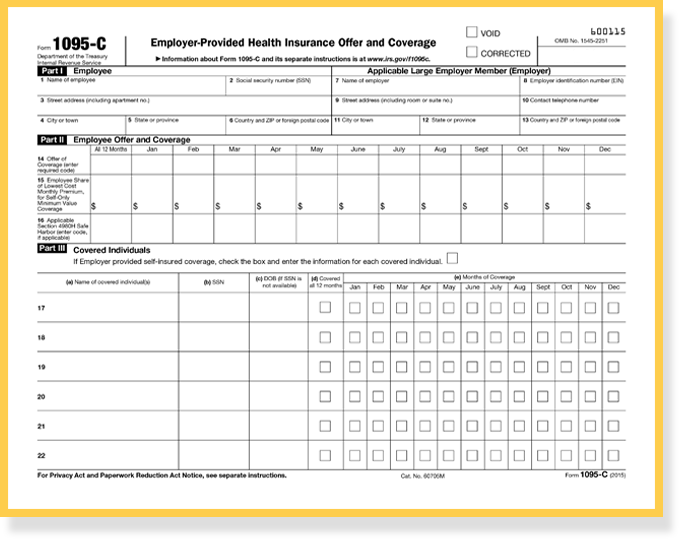

1095-C

Employer-Provided Health Insurance Offer and Coverage

(ALEs) Insured and Self-Insured Employers with 50+ full-time employees

Whether or not the employer offered health coverage to employees

Paper:

February 28*

Electronic:

March 31*

Yes, by

March 2

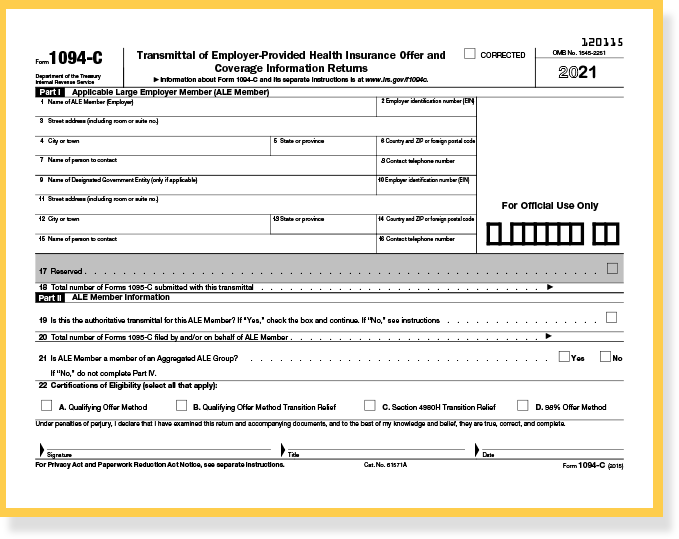

1094-C

Transmittal of Employer-Provided Health Insurance

Offer and Coverage Information Returns Integrated with online accounting software

Summary transmittal record of 1095-Cs

Paper:

February 28*

Electronic:

March 31*

N/A

Self-insured businesses with fewer than 50 full-time employees must complete Form 1095-B (and the 1094-B transmittal).

To report the necessary information to the IRS and furnish a form to employees, you’ll need to complete:

The 1094-B transmittal form represents the total 1095-B filing submitted for the season. Acting as a cover sheet, it’s a brief form that includes:

To satisfy the ACA reporting requirements, fully insured and self-insured ALEs must complete Form 1095-C (and the 1094-C transmittal).

If you’re a fully insured employer, you’ll complete Parts I and II of the 1095-C. Self-insured employers will complete Parts I, II and III. Every employee of an ALE who is eligible for insurance should receive a 1095-C. That means eligible employees who decline to participate in an employer’s health plan still receive a 1095-C.

To report the necessary information to the IRS and furnish a form to employees, you’ll need to capture several details, as follows:

Includes identifying information for the employee, such as name, address and Social Security number – and identifying information for the employer, such as name, address and Employer Identification Number (EIN).

This section pertains to the offer of coverage. In the three lines here, you enter information about the health coverage offered by month (if any), the employee share of the monthly cost for the lowest-cost, self-only, minimum essential coverage providing minimum value that is offered to the employee and the months you met an affordability safe harbor or made other relief available to the employee.

This section includes information about covered individuals’ enrollment in an employer-sponsored, self-insured health coverage, including an individual coverage HRA. You’ll need Social Security numbers or, if these numbers aren’t available, dates of birth. (Note: This information isn’t completed by insured employers because it’s captured separately by the health insurance providers themselves, through the 1095-B.)

The bulk of the work in completing the 1095-C is with Lines 14-16 in Part 2.

The “Offer of Coverage” on Line 14 – which involves 21 codes, 1A through 1U – describes whether minimum essential coverage was offered to any employee, spouse and/or any dependents. This captures the offer and not necessarily the actual coverage. If one code applies for the entire 12 months, you only need to enter it once in the “All 12 Months” column.

On Line 15 you’re reporting the employee share of the lowest-cost monthly premium for self-only minimum value coverage. This helps the IRS determine if affordable coverage was made available to the employee. You only fill out this section if you entered code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U on line 14 either in the “All 12 Months” box or in any of the monthly boxes. Include cents with this amount and don’t round the numbers. If you entered 1A on Line 14, nothing needs to be entered on Line 15 because this code indicates you offered essential coverage providing minimum value to the employee, spouse and/or dependents.

Line 16 – which involves 8 codes again, 2A-2H – clarifies issues such as whether an individual was employed during the month, whether the employee was eligible and/or enrolled in coverage, if any affordability safe harbors applied when an employee declined coverage and if the employee was in a waiting period or other limited non-assessment period for which you’d be liable for a penalty. Basically, you’re giving the IRS a reason why you shouldn’t be penalized under the Employer Shared Responsibility provision. Again, you only fill this out if a code applies to the employee for any particular month.

The 1094-C transmittal represents the total 1095-C filings submitted for the season. Acting as a cover sheet, it

includes:

Clearly, there’s a great deal of information to be collected and reported on these ACA information returns. Using online, cloud-based services from us to manage this process is the most convenient way to meet the requirements.